South Korea is buying U.S. grains in all forms at explosive rates, due in large part to the free trade agreement between it and the United States, the U.S.-Korea Free Trade Agreement or KORUS, which went into effect in 2012, and commensurate growth in the country’s livestock and poultry sectors reports theU.S. Grains Council (USGC).

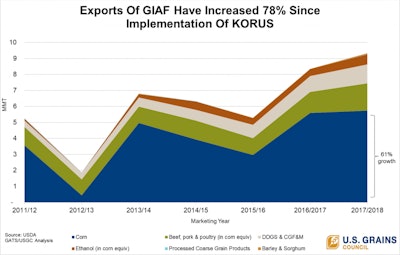

Since KORUS was implemented, grains in all forms sales have increased 78%, and Korea has set or broken sales records for purchases of U.S. corn, sorghum, ethanol and distiller’s dried grains with solubles (DDGS).

South Korea increased purchases of U.S. feed grains and co-products by 11.8% to 9.33 million metric tons (367 million bushels) – a new record – in 2017/2018.

The country ranked as the second largest buyer of U.S. DDGS, the third largest buyer of U.S. corn and the sixth largest buyer of U.S. ethanol.

“The growth in demand for U.S. commodities like corn, DDGS and ethanol in Korea is the direct result of years of Council’s groundwork,” said Haksoo Kim, USGC director in South Korea. “The Council has been here actively promoting these commodities and – in the case of DDGS – directly building demand. It’s only gotten better since the two countries signed the KORUS agreement.”

Beyond the topline numbers, here are some impressive statistics that can be gleaned from this chart of note:

U.S. DDGS Sales

Purchases of 1.18 million metric tons (153 million bushels in corn equivalent) of U.S. DDGS officially exceeded the one-million-ton mark for the first time and represent a 22.3 percent increase year-over-year. Each year, the country has increased DDGS purchases steadily, setting a new high each year since 2010/2011. DDGS purchases for 2017/2018 increased by 19 percent over the same period the year before, showing that Korea’s poultry sector has fully recovered from damage caused by the 2016 avian flu outbreak.

The nation has seen a 3.5 percent increase in its poultry numbers, a 1.3% rise in its swine inventory and a 0.3% increase in its cattle inventory over the last year.

Now, 97% of feed millers in South Korea include U.S. DDGS in their rations for the country’s livestock and poultry industries, thanks to work started by the U.S. Grains Council (USGC) in 2004 to introduce this feed ingredient. The Council continues to work to increase average inclusion rates by providing additional technical expertise and business opportunities between U.S. suppliers and Korean buyers.

U.S. Corn Sales

Overall, U.S. corn exports to South Korea have increased 61% since KORUS went into effect in 2012. In 2017/2018, the country purchased 5.74 million metric tons (226 million bushels) of U.S. corn, an increase of 2.4% over the previous year. The increase in corn imports is due to increased poultry and duck feed production and decreases in feed wheat imports compared to the same period last year. U.S. corn sales captured 66.3% of the Korean market in 2018.

U.S. Ethanol Sales

Even though there is no fuel ethanol market in South Korea, U.S. industrial ethanol imports have seen record-breaking growth this year and increasing a whopping 400 percent since KORUS went into effect. Imports of U.S. ethanol jumped 47.3% to 69.7 million gallons (24.7 million bushels in corn equivalent) in 2017/2018.

In the same year, U.S. ethanol had 52 percent market share – 107.4 million gallons of ethanol (38.1 million bushels in corn equivalent) – in South Korea. The country uses roughly 140 million gallons of ethanol (49.6 million bushels in corn equivalent) each year, about 100 million gallons (35.5 million bushels in corn equivalent) of which are imported from the United States, Brazil and Pakistan.

The main reason for the exponential increase in U.S. ethanol sales this year is that the Korean Ministry of the Environment banned methanol windshield wiper fluid as a hazardous chemical in January 2018, and methanol was completely replaced by ethanol. The Korean government is also converting methanol in concrete curing compounds and solid fuels in the country, and ethanol is the chief replacement element.

U.S. Sorghum and Barley Sales

Sales of U.S. sorghum and barley have also been impressive in the last marketing year. Sorghum set a new record – increasing 60-fold year-over-year to 59,800 metric tons (2.35 million bushels) – a temporary increase due to the disruption of the U.S. sorghum imports in China and mostly used for feed. U.S. barley purchases increased by 116% – to 7,290 metric tons (335,000 bushels) – since KORUS went into effect.

的更多信息USCG's efforts,click here.